Discover the Factors You Required to Locate a Medicare Advisor for Your Coverage

Steering through the intricacies of Medicare can be intimidating for many people. With different coverage choices and strategies, recognizing what finest fits one's wellness needs and monetary circumstance is crucial. A Medicare advisor offers customized guidance to help make informed selections. The factors to seek their expertise prolong beyond simply initial enrollment. There are critical aspects that can significantly impact long-lasting wellness results and monetary stability.

Understanding the Medicare Landscape

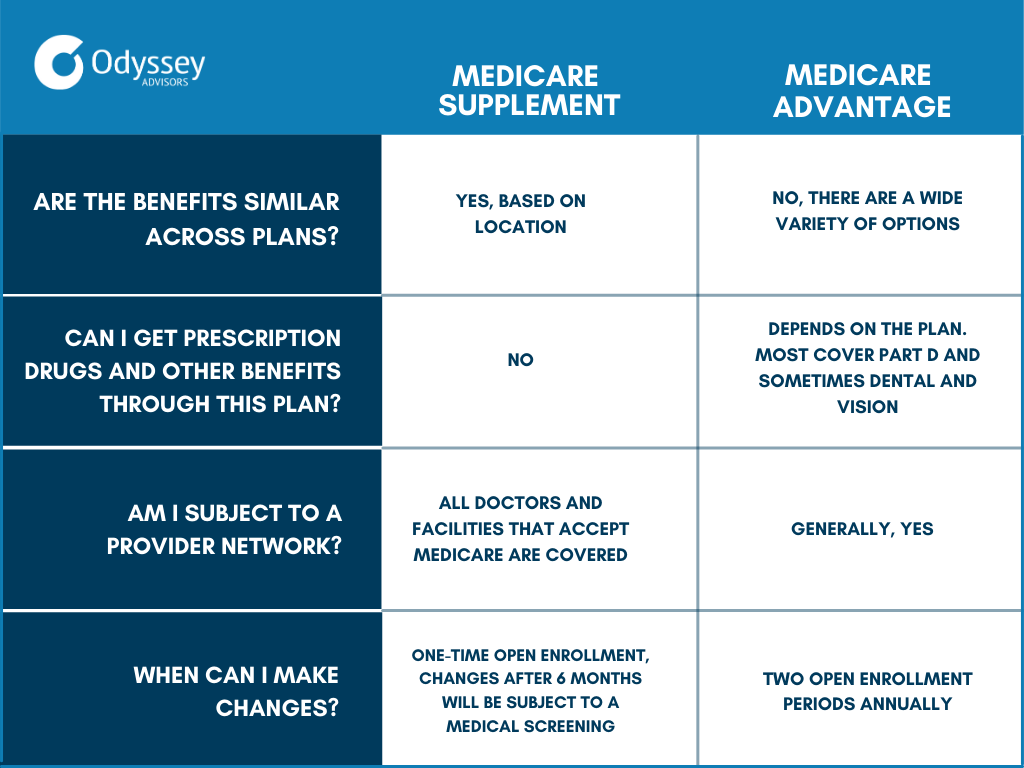

What factors should individuals think about when maneuvering the intricacies of Medicare? One essential facet is understanding the different parts of Medicare: Component A covers healthcare facility insurance, while Component B focuses on medical insurance. People have to also be conscious of Medicare Benefit Program, which provide an alternate means to obtain Medicare advantages with personal insurers. In addition, experience with prescription medication protection under Part D is critical, as it can greatly influence out-of-pocket expenses for medications.

An additional vital consideration is eligibility and registration periods. Missing deadlines can lead to charges or gaps in protection. People must additionally assess their one-of-a-kind medical care demands, including liked carriers and essential treatments. Ultimately, financial variables, such as costs, co-pays, and deductibles, should be examined to assure that the selected strategy straightens with their spending plan. By very carefully analyzing these components, people can much better navigate the Medicare landscape and make educated decisions concerning their medical care coverage.

Personalized Assistance Tailored to Your Requirements

Customized advice is essential for people maneuvering the complexities of Medicare. A skilled advisor can give personalized plan referrals that line up with particular health and wellness needs and financial scenarios - Medicare agent. This customized technique simplifies the decision-making process, making sure that recipients choose the most effective options available

Custom-made Plan Referrals

Numerous individuals seeking Medicare protection advantage significantly from tailored strategy suggestions that line up with their distinct health care demands and economic scenarios. These customized recommendations take into consideration aspects such as existing medical conditions, prescription medicine demands, and financial restraints. By evaluating a person's health and wellness background and future health care expectations, advisors can recommend plans that provide the necessary benefits while minimizing out-of-pocket expenses. In addition, customized suggestions ensure that individuals recognize their options, equipping them to make informed choices. This personalized technique not only boosts fulfillment with the selected coverage but likewise aids in staying clear of unnecessary costs or spaces in treatment. Ultimately, personalized plan referrals function as a critical resource for those going across the complexities of Medicare.

Navigating Complicated Choices

As individuals come close to the decision-making procedure for Medicare insurance coverage, steering through the complicated array of alternatives can commonly feel frustrating. With numerous plans, benefits, and qualification needs, the options might seem intimidating. This complexity demands personalized assistance tailored to specific demands. A Medicare advisor can offer quality, helping customers recognize the nuances of each option and just how they straighten with their health care requirements and financial situations. Advisors evaluate personal health and wellness backgrounds, choices, and budget restraints to advise one of the most suitable plans. By leveraging their proficiency, individuals can with confidence navigate the complexities of Medicare, guaranteeing they pick coverage that finest fulfills their requirements without unnecessary complication or anxiety. Engaging a Medicare advisor eventually simplifies the decision-making process and boosts fulfillment with picked strategies.

Optimizing Your Benefits and Coverage

How can one assure they are totally leveraging their Medicare advantages and protection? Engaging a Medicare advisor can be an essential action in this process. These professionals have extensive knowledge of the numerous Medicare strategies and can assist individuals comprehend which options finest fit their health care requires. By reviewing individual case history, prescription drugs, and chosen health care carriers, an expert can assist recipients towards plans that provide suitable insurance coverage.

Additionally, advisors may aid in recognizing supplemental insurance policy options, such as Medigap or Medicare Advantage, which can enhance overall benefits. They likewise offer understandings right into preventative services offered under Medicare, making sure people capitalize on health check outs and testings. Inevitably, a devoted Medicare advisor equips beneficiaries to make educated decisions, guaranteeing they maximize their benefits and coverage while lessening out-of-pocket costs. This strategic method results in much better healthcare results and monetary assurance.

Browsing Registration Durations and Due Dates

When should individuals pay closest interest to Medicare registration durations and due dates? Comprehending these durations is essential for safeguarding the ideal coverage. The Initial Enrollment Period (IEP) starts three months prior to an individual turns 65 and lasts 7 months, permitting registration in Medicare Part A and Component B.

Subsequent enrollment periods, such as the Annual Registration Duration (AEP) from October 15 to December 7 yearly, offer opportunities to make modifications to existing strategies or register in brand-new ones.

Additionally, Special Registration Periods (SEPs) may make an application for those experiencing certifying life events, such as moving or losing various other wellness insurance coverage. Missing these essential windows can cause delays in coverage or increased costs - Medicare agent. Therefore, speaking with a Medicare advisor can help individuals navigate these durations successfully, guaranteeing they make informed choices that line up with their health care needs

Staying Clear Of Costly Blunders

Understanding Plan Options

Steering the intricacies of Medicare plan alternatives can be frightening for lots of people. With various components-- A, C, b, and d-- each offering distinctive benefits, recognizing these choices is important to avoid costly errors. Individuals commonly misinterpret protection details, leading to unanticipated out-of-pocket costs or gaps in treatment. Falling short to acknowledge the distinctions in between Original Medicare and Medicare Advantage can result in insufficient coverage for specific health and wellness demands. Furthermore, neglecting extra policies may leave beneficiaries susceptible to high expenses. Engaging a Medicare advisor can supply individualized support, making certain individuals select the ideal strategy tailored to their health and wellness requirements and financial circumstance. This aggressive approach can considerably improve general fulfillment with Medicare coverage.

Navigating Enrollment Due Dates

Understanding registration target dates is crucial, as missing them can result in considerable economic fines and spaces in protection. Medicare has specific durations, including the Initial Registration Period, General Registration Period, and Unique Enrollment Periods, each with unique timelines. A Medicare advisor can assist people navigate these vital days, ensuring they enroll when eligible. Failure to follow these target dates may cause delayed protection, higher premiums, and even lifetime penalties. Advisors offer tailored tips and assistance to assist customers understand their alternatives and timelines. By looking for specialist advice, beneficiaries can avoid costly mistakes and secure the coverage they require without disturbance. Appropriate preparation browse around this web-site can make a considerable difference in maximizing Medicare benefits and lessening out-of-pocket costs.

Remaining Informed About Adjustments in Medicare

As modifications to Medicare policies and policies occur frequently, it becomes important for beneficiaries to stay notified. Medicare advisor near me. Comprehending these changes can significantly impact the coverage alternatives offered and the prices connected with them. Medicare advisors play a crucial role in keeping clients updated about new plans, advantages, and potential mistakes

Beneficiaries need to proactively engage with numerous resources of details, consisting of main Medicare announcements, respectable health care internet sites, and neighborhood workshops. Normal testimonial of these resources assists guarantee that individuals understand any kind of adjustments that might influence their coverage or eligibility.

Recognizing changes in Medicare can encourage beneficiaries to make enlightened choices concerning their healthcare. This knowledge can lead to better economic preparation and boosted health care outcomes. Eventually, remaining notified is not simply helpful; it is a need for navigating the intricacies of Medicare efficiently.

Constructing a Long-Term Connection for Future Requirements

While lots of recipients concentrate on prompt demands and adjustments in their Medicare plans, developing a lasting partnership with a Medicare advisor can provide continuous benefits that prolong well past initial enrollment. Medicare advantage agent near me. A devoted advisor acts as a regular source, supplying insights into progressing healthcare alternatives and legal changes that might impact protection

As recipients age, their medical care requires usually change, making it vital to have someone who comprehends their distinct scenario and can recommend ideal changes. This relationship cultivates depend on and guarantees that beneficiaries obtain customized advice, optimizing their advantages while reducing prices.

Frequently Asked Concerns

What Certifications Should I Search for in a Medicare Advisor?

When looking for a Medicare advisor, one ought to focus on certifications such as qualification in Medicare preparation, substantial experience in the field, knowledge of numerous strategies, and a solid credibility for supplying personalized, unbiased advice tailored to individual requirements.

Just How Much Does Employing a Medicare Advisor Usually Cost?

Employing a Medicare advisor typically costs between $0 to $500, depending on the solutions offered. Some advisors obtain commissions from insurance provider, making their examinations complimentary for customers, while others may bill a level charge.

Can a Medicare Advisor Assist With Prescription Medication Plans?

A Medicare advisor can help people in guiding with prescription medication plans by evaluating options, contrasting costs, and making sure recipients choose a plan that meets their needs, inevitably boosting their healthcare experience and economic preparation.

Are Medicare Advisors Available in All States?

Yes, Medicare advisors are offered in all states. They provide assistance to people passing through Medicare options, guaranteeing access to necessary details and sources tailored per individual's special healthcare demands and situations.

How Often Should I Get In Touch With With My Medicare Advisor?

Consulting with a Medicare advisor annually is suggested, particularly during open enrollment durations. People may benefit from added consultations when experiencing substantial life modifications or when needing clarification on new protection options or advantages.

People should additionally be conscious of Medicare Benefit Plans, which supply an alternate method to get Medicare benefits with private insurance firms. Ultimately, a dedicated Medicare advisor equips recipients to make informed choices, guaranteeing they maximize their advantages and coverage while lessening out-of-pocket expenditures. Failing to acknowledge the distinctions between Initial Medicare and Medicare Benefit can result in poor coverage for details wellness requirements. Engaging a Medicare advisor can supply customized support, ensuring individuals choose the best plan tailored to their health demands and monetary scenario. While numerous beneficiaries concentrate on immediate needs and modifications in their Medicare strategies, constructing a lasting relationship with a Medicare advisor can provide recurring advantages that extend well beyond initial enrollment.